Capital Allowances on Property Purchases

If you are buying property, capital allowances may be a vital consideration. In this context, capital allowances act as an Income Tax or Corporation Tax relief on capital expenditure incurred when purchasing property. As such, a capital allowance claim deducted from your taxable profits can result in significant tax savings when used in the right context.

The rules around claiming capital allowances when buying property can be complex, and depend on more than just making a qualifying capital expenditure - the actions of the seller (and even prior sellers) must be taken into account before you can claim tax relief using property capital allowances. As such, it is vital to work with an expert tax adviser to help you reduce your taxable profits and make the most of these potential savings.

Monetta's experts have a wealth of experience in this area, and can advise you on all aspects of property transactions, including whether you are eligible to obtain capital allowances. If you are, we can help you to make your claim and potentially identify other areas where you may be able to apply for tax relief and save money. Capital allowances are at risk of going unclaimed, but with our support you can make sure you benefit from all of the applicable savings.

To learn more, call your local Monetta office or use our enquiry form to arrange a call back. Our experts can provide the services you need to maximise the value of a property purchase.

When can you claim capital allowances on property purchases?

Having established that capital allowances are tax relief on capital expenditure available to Income Tax and Corporation Tax payers, it is important to understand the situations where it should be considered. By understanding where property capital allowances can be used, businesses can make the best use of them to minimise their tax liability.

To dispel a common misconception, capital allowances are not only available on construction of property. They can also be available on the acquisition of properties and this is an important consideration, particularly to solicitors. The type of property and claims made by previous owners determines the amount of capital allowances available, and certain property types can yield up to 40% of the purchase price being attributed to capital allowances.

The acquisition of a commercial property presents an opportunity to benefit from unclaimed capital allowances that otherwise would be missed. However, there is a process which should be followed in order to secure the right to claim this tax relief.

How to claim capital allowances on property

The process of claiming capital allowances is complicated without expert support. However, it will generally unfold as follows:

Step one: Engage with a capital allowances expert

There is a due diligence exercise required when acquiring a property. This involves trying to ascertain the correct starting position with regard to the capital allowances. Many capital allowance advisers and solicitors use Commercial Property Standards Enquiries (“CPSE”), but they may have their own version. Within this is a section on capital allowances.

It is essential that the replies are correctly answered - “not applicable” or “purchaser to make own enquiries” are no longer acceptable replies. Monetta can advise you on this and, once the correct replies have been received, we can confirm the next steps.

Step two: Establish the basis of capital allowances claim

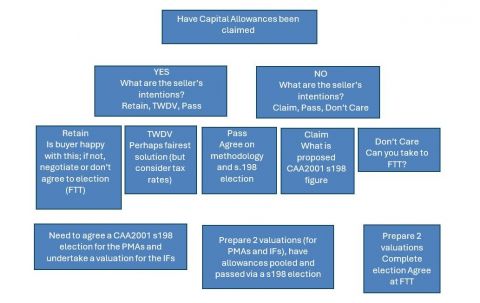

There are several options that may follow the first stage, depending on the answer to the CPSE. The flow chart below indicates some of the pathways through the process and the results you can expect.

Two of the most important outcomes are as follows:

- If the seller did not claim capital allowances because they were not able to, the basis of the claim could be the price paid by the buyer. However, this requires a series of checks on past sellers to make sure you remain eligible to claim in this way.

- If a seller has not claimed capital allowances but could have, we would need them to agree to pool the unclaimed allowances and pass them to the buyer via a CAA2001 s198 election. This process is often referred to as the mandatory pooling requirement.

Because there are many variations involved when trying to claim allowances in this way, you should instruct a capital allowance specialist from Monetta at the earliest possible point during any property transactions.

Step three: Apportioning acquisition costs

Once the correct basis of entitlement has been established, there will be one or two valuations required depending on basis. In either case, the process is known as a 'CAA2001 s562 apportionment of the purchase price'. There are three components to this valuation:

- Valuation of the land

- Valuation of the building

- Valuation of the plant & machinery

Once the three components have been calculated, we would reconcile this against the acquisition costs of the first entity that would have been entitled to make a claim.

Step four: Pooling and completing the CAA2001 s198 election

If there is a mandatory pooling requirement, the seller will need to pool but not claim the allowances within their tax computations. A CAA2001 s198 election should also be submitted by both parties, within two years from the date of sale.

These are the main steps to ensure any capital allowances are safeguarded when acquiring a commercial property. By working with an experienced professional, you can take these steps more easily without facing any delay to the transaction. Commercial property owners who need advice on using capital allowances to reduce their taxable income should speak to Monetta's team as soon as possible.

Can I claim capital allowances for an older property?

Another misconception is that many people believe that there is no point in investigating the possibility of capital allowances when a property transaction involves an older building. However, this is not the case - it is always worth investigating this possibility, given the value of the tax savings potentially on offer.

The capital allowances fixtures legislation allows for apportioning part of the acquisition price of a property to the plant and machinery within that building. As such, this may enable property buyers to benefit from plant and machinery allowances on the transaction. However, this follows a complex set of rules, and it is best to work with an experienced capital allowances specialist to take full advantage of this. When simplified, the rules imply that the right to capital allowances is an apportionment of the costs paid by the first entity able to claim the tax relief, regardless of whether they decide to do so or not. As such, you should always seek advice about capital allowances on any property transactions.

In one example, we looked at the availability of capital allowances for a client buying an office building for £1.2m. The seller, who owned the property for almost 10 years, purchased it for £1.8m from a developer. Our client was able to claim in excess of £450,000 of capital allowances despite the age and condition of the property.

Historical purchases

For properties purchased before April 2014, the old fixtures rules still apply. Therefore, as long as previous sellers have not made a claim, the current owner will be able to make an unrestricted claim. The value of the allowances will not have decreased because the property has been owned and used for some time, as the basis of the valuation is the date of completion.

In a recent case, Monetta was asked to project the potential capital allowances for a property which was to be refurbished the following year. During discussions, we ascertained that the seller purchased the property in January 2012 and had not apportioned this purchase price. A £6m purchase provided them with £1.4m of capital allowances, and the option to claim additional capital allowances on the subsequent refurbishment, too.

As these examples show, capital allowances on property acquisitions can provide generous levels of capital allowances. However, buyers need to engage with the sellers to ensure the correct process has been followed; otherwise, the entitlement to the capital allowances will be lost, not only to the new owner but also to any subsequent owner.

Why choose Monetta?

At Monetta, our capital allowance experts have helped many businesses to claim capital allowances and benefit from tax savings. The most important considerations when claiming capital allowances are whether you are eligible, and how the claim will affect your overall tax position. Because our team specialises in this area and has a wealth of tax experience at its disposal, we can examine your circumstances thoroughly and empower you to make the most cost-efficient decisions.

The interactions of capital allowances, tax reliefs and exemptions and other allowances can be complicated, but with Monetta's expertise, you can secure every available tax benefit and minimise your tax bill. Thanks to our experience, we can help you to review available allowances and tax benefits to save the maximum amount of tax possible in your situation. As experts in commercial property transactions, we are well-positioned to support businesses of all sizes through this process.

Contact Us

To find out how we can help with capital allowance claims and tax advice on property transactions, speak to Monetta's experts today. Call your local Monetta office or fill in our online enquiry form to request a call back at a time that is convenient for you. Alternatively, visit our team page to find out more about our expert advisers and what they can do for you and your business.

Speak to one of our experienced team.

To speak to a member of our team, please call us or enter your details below.